Pentru inceput

De la economii la investitii pe bursa

Prin economisire se urmareste crearea unor rezerve de bani care sa fie pastrate in conditii de risc cat mai mic, daca se poate chiar inexistent.

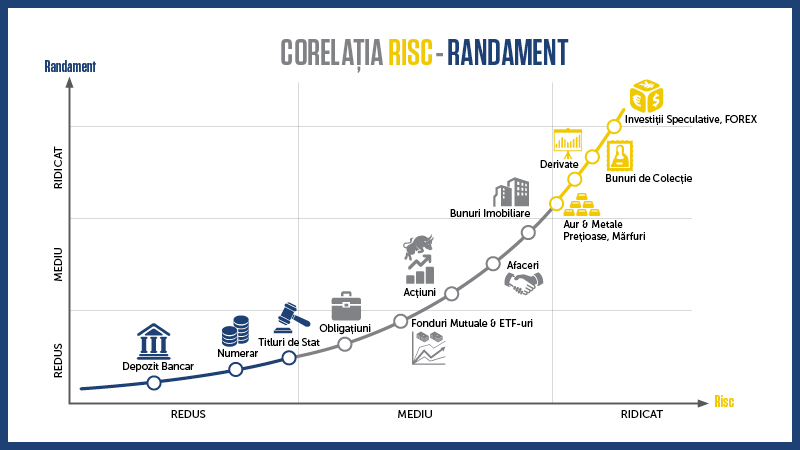

Cele mai potrivite instrumente pentru plasarea banilor economisiti sunt cele cu lichiditate ridicata si risc scazut. Bineinteles, in aceste conditii randamentul obtinut va fi de asemenea redus. Printre instrumentele financiare care corespund acestor caracteristici se numara depozitele bancare, titlurile de stat (certificatele de trezorerie pentru populatie). Castigul care se obtine din plasarea economiilor in aceste instrumente financiare este reprezentat de dobanda, care poate fi fixa sau variabila.

De cealalta parte, investitiile au ca scop principal cresterea capitalului investit si realizarea unui profit cat mai ridicat, in conditii acceptabile de risc, diferit de la o persoana la alta.

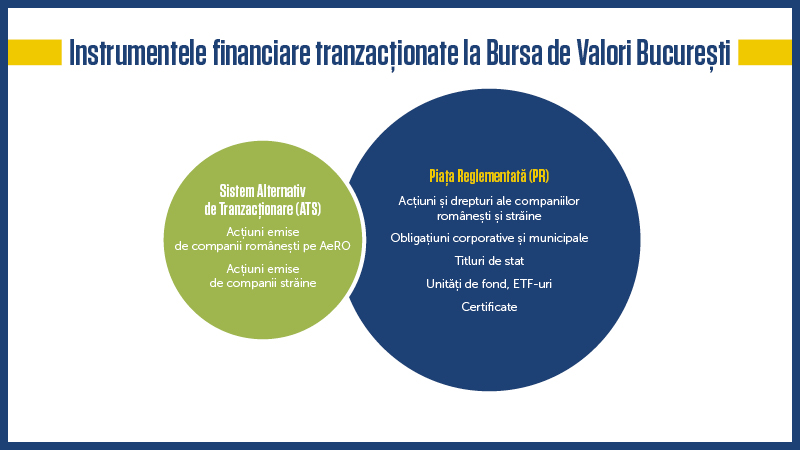

In categoria investitiilor intra cea mai mare parte a tipurilor de plasamente: de la cele cu risc mai redus, cum sunt obligatiunile emise de companii private (obligatiuni corporative), si pana la cele cu risc mai ridicat, de tipul actiunilor listate la bursa, sau cu risc foarte ridicat, cum este cazul instrumentelor derivate. Toate acestea sunt investitii in instrumente financiare.

Castigul care se obtine din investitiile in aceste instrumente financiare este reprezentat, in general, de diferenta dintre pretul de cumparare si cel de vanzare. De asemenea, detinatorii de actiuni, in calitatea lor de actionari ai companiilor emitente, pot beneficia de dividende, care se adauga la randamentul obtinut din diferenta de pret. Detinatorii de obligatiunilor emise de companii private sunt remunerati prin dobanda, fixa sau variabila.

Sinteza principalelor caracteristici ale economisirii si investitiei

|

Economisire |

Investitie |

| Obiectivul |

Acumularea de capital |

Cresterea capitalului investit si obtinerea unui profit |

| Riscul asumat |

Redus |

Ridicat, in functie de instrumentul financiar ales |

| Randamentul potential |

Redus |

HighRidicat, in functie de instrumentul financiar ales |

Stabilirea unei strategii proprii de investitii si analiza

Procesul de investire trebuie sa fie precedat de doua activitati determinante: stabilirea strategiei de plasament si analiza caracteristicilor pietei si a instrumentelor disponibile.

Strategia de plasament pentru investitiile la bursa vizeaza:

- obiectivele investitorului

- orizontul de timp pentru care se va investi

- nivelul de lichiditate dorit de investitor si eventualele restrictii

- riscul maxim tolerat.

Odata stabilita strategia de investitii, pasul urmator il reprezinta selectia instrumentelor financiare ce vor fi incluse in portofoliu, combinate astfel incat sa indeplineasca criteriile mentionate in strategie. Selectia implica o analiza atenta a caracteristicilor companiilor sau instrumentelor financiare vizate, a performantelor acestora pe parcursul ultimilor ani, pentru a se putea contura tendinta viitoare de evolutie.